The 5-Second Trick For Dubai Company Expert Services

More About Dubai Company Expert Services

Table of ContentsDubai Company Expert Services Things To Know Before You BuyDubai Company Expert Services Can Be Fun For AnyoneAn Unbiased View of Dubai Company Expert ServicesSome Known Questions About Dubai Company Expert Services.The Definitive Guide to Dubai Company Expert Services

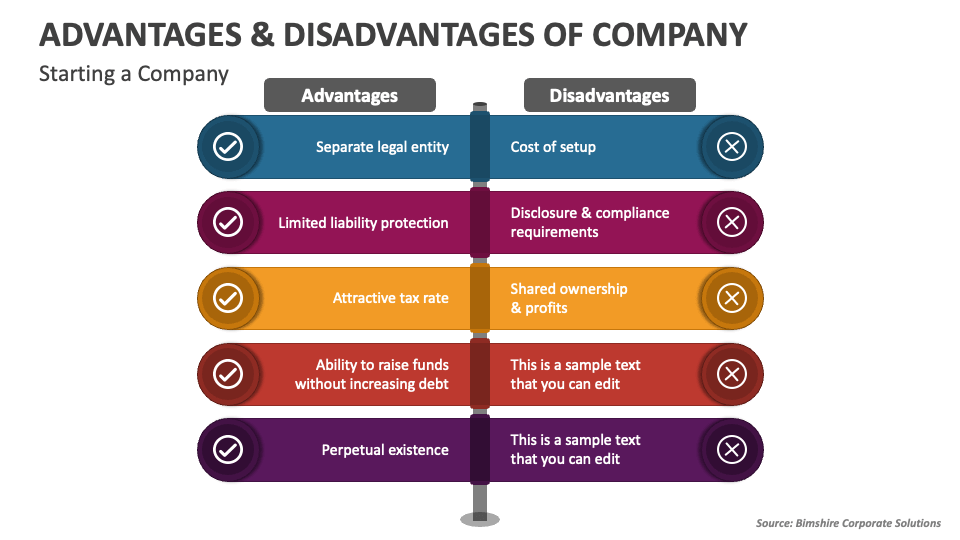

If one investor has greater than 25 percent of the shares, they are dealt with in business legislation as 'persons of significant passion' because they can affect decisions made regarding the company. Private restricted companies provide a variety of essential benefits compared to organizations operating as sole investors. As a sole trader, you are directly liable for all the financial obligations and also liabilities of your business.That minimizes the danger of having your personal assets seized to pay for the debts of the business if it fails. A private minimal company is viewed as more substantial than businesses run by a single investor.

Related: What is EIS? - alternative financing choices for small companies Related: What is SEIS? - Alternate local business funding Sole investors pay earnings tax and National Insurance payments on the earnings of business through a yearly self-assessment income tax return. Dubai Company Expert Services. The rate of income tax obligation as well as National Insurance payments amounts that of an exclusive individual and consists of the same individual allocations.

You can likewise raise funding by selling shares in your service, although you can not provide them for public sale. Connected: A guide to crowdfunding as well as the most effective crowdfunding sites UK When you register your company name with Business House, the name is shielded as well as can not be made use of by any various other organization.

The smart Trick of Dubai Company Expert Services That Nobody is Talking About

If Companies Home identify a coordinating name or a name that is very similar, they will certainly suggest business as well as decline to provide consent. This level of security makes it tough for various other firms providing duplicates of your items can not 'pass-off' their items as authentic. Connected: Lawful facets of beginning a local business.

As dividends are exhausted at a lower rate, this will minimize your tax expense as well as offer a more tax efficient method of reimbursement compared to income alone. There are likewise other ways to take cash out of business as a supervisor, consisting of incentive repayments, pension plan contributions, directors' fundings as well as private investments.

Sole traders do not have the exact same flexibility. They take revenue from the profits of business as well as the revenue is exhausted at standard personal revenue prices. Associated: Calculating tax obligation on rewards: A guide & instance In a limited firm, you may be able to make use of a firm pension plan system As spending funds in an exclusive personal pension system.

It exports almost S$ 500 billion well worth of exports each year with the outcome that this nation with only 5. 25 million individuals has actually amassed the 10th largest foreign currency books in the world.

Getting My Dubai Company Expert Services To Work

In a similar way, the individual tax rate begins at 0%, increases extremely gradually to a maximum of 20% for revenues over S$ 320,000. Company profits are not dual strained when they are passed to investors as returns. Simply put, dividends are dispersed to shareholders tax-free. Finally, Singapore charges among the cheapest worth added tax obligation rates in the world.

These agreements are developed to make sure that economic purchases between Singapore and also the treaty country do not deal with double taxes. Moreover, Singapore provides Independent Tax Credits (UTCs) for the situation of countries with which it does not have a DTA. Thus, a Singapore tax obligation resident firm is extremely not likely to struggle with double taxes.

You do not need any type of neighborhood partners or shareholders - Dubai Company Expert Services. This allows you to begin a company with the kind of resources structure that you prefer and also distribute its ownership to fit your financial investment needs. There are no limitations on the quantity of capital that you can bring from your home country to spend in your Singapore firm.

No taxes are enforced on capital gains from the sale of an organization. This smooth movement of funds throughout borders can provide severe flexibility to a business.

Dubai Company Expert Services Fundamentals Explained

Singapore has among the most efficient as well as bureaucracy-free regulatory frameworks worldwide. For nine successive years, Singapore has actually placed primary on Globe Bank's Ease of Doing Company study. The requirements for including a business are straightforward as well as the treatment for doing so is easy. It takes much less than a day to incorporate a brand-new firm most over here of the times.

The port of Singapore is among the busiest in the whole world and is categorized as a significant International Maritime Facility. Singapore's Changi Flight terminal is a world class flight terminal that provides to about 20 million guests every year and offers practical trips to almost every significant city in globe.

Singaporeans are several of one of the most effective and also well experienced employees on the planet. The nation's superb education and learning system generates a labor force that is efficient what it does, yet on wages it is extremely competitive with various other nations. Singapore is regarded as a regulation adhering to, well-functioning, modern-day and also sincere nation.

By situating your company in Singapore, you will signify professionalism and reliability and also top quality to your clients, partners and providers. The impression they will have of your company will be that of a professional, experienced, straightforward, and also well-run firm.

10 Easy Facts About Dubai Company Expert Services Shown

Consider the following: The legal rights and lawful obligations of those who participate in the service That controls find out the business as well as the degree of control you intend to have How complicated you desire the firm's structure to be The life expectancy of the company The finances, including taxes, financial obligation, and obligations Your over factors to consider will identify the kind of business you'll create, but you ought to probably obtain legal guidance on the most effective kind of firm for your scenario.

This is one of the easiest methods more tips here to begin a business as well as the most common type of service. In this type of arrangement, participants might equally divide the revenues as well as losses and carry the liability, unless a composed agreement defines just how these points are to be shared.